Barriers, Giants, and Imaging Wars: The Competitive Moats of Medical Imaging

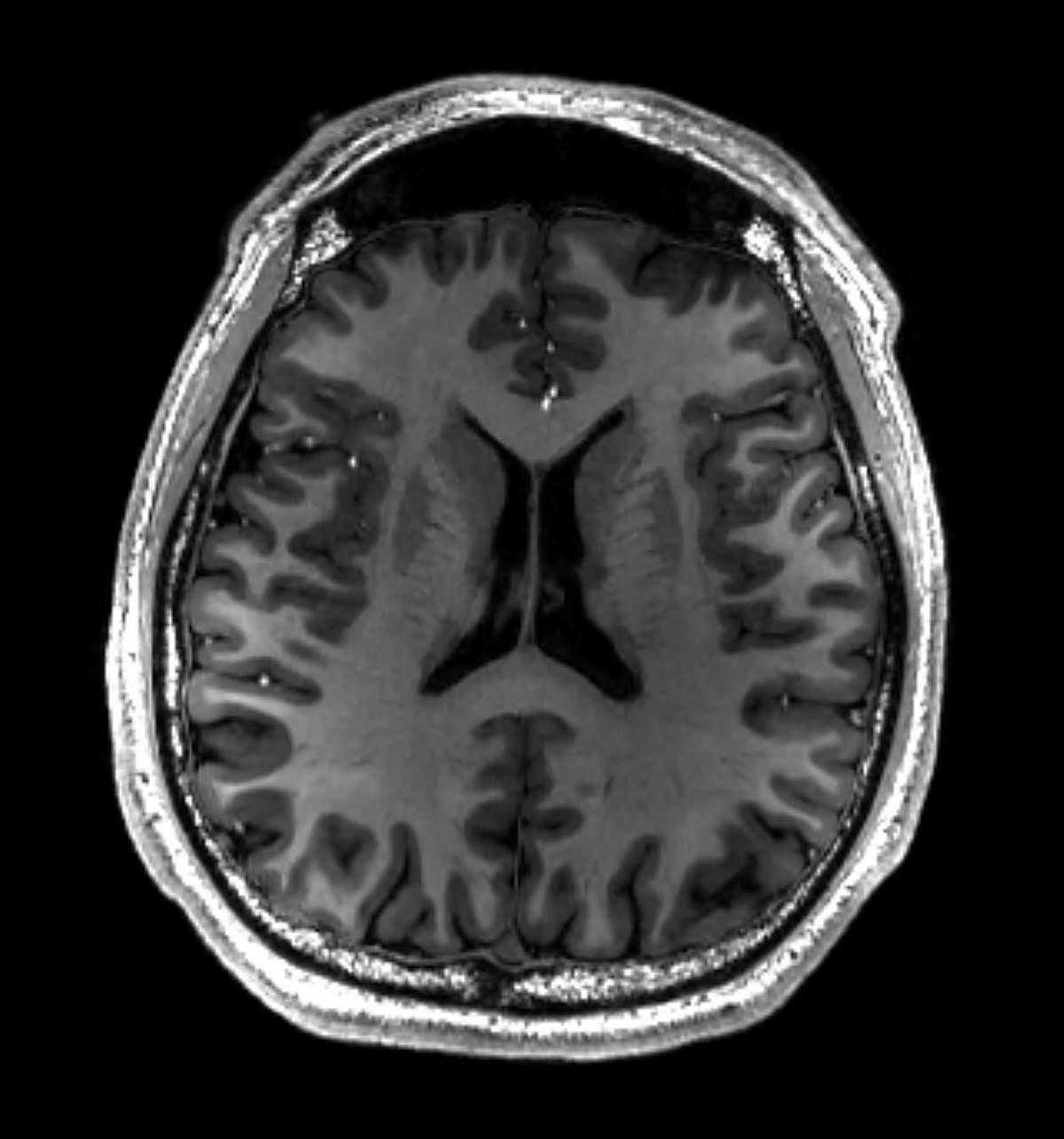

For a young mother in Bhubaneshwar, a persistent headache was more than just an inconvenience. It was a source of gnawing anxiety. Reassured by her doctor’s recommendation, she underwent an MRI brain scan, hoping for clarity and a path towards relief. Her experience, like that of countless other patients across India, illustrates the critical role that Diagnostic Medical Imaging (DMI) equipment plays in healthcare. However, the market for DMI equipment in India, particularly CT scanners and MRI machines, presents a complex interplay of stakeholders and competitive forces. While the industry shows promise with a projected market value of INR 20,968 crores by 2026, a closer look reveals a landscape marked by high concentration, barriers to entry, and varying levels of competition across the value chain.

Oligopoly at the top

The market for new DMI equipment, particularly CT and MRI machines, exhibits a highly concentrated structure, with a small number of global Original Equipment manufacturers (OEMs) holding a dominant position. Based on the data available on AERB portal on the number of CT scan machines installed in hospitals and diagnostic centres across India, it is observed that GE holds a market share of ~44.8% in India, followed by Siemens at approximately 31.3%. Canon (including Toshiba) and Philips account for approximately 10.5% share and 8.4% of the market shares, respectively. Table below provides the market shares enjoyed by OEMs in the market based on total number of CT Scan machines installed in India. This is a cumulative number of total machines presently in use. As can be seen in Table 6, top 5 OEMs together capture ~98 percent of the market, conforming with characteristics of an oligopolistic market.

| Sr. No. | Manufacturer | Number of CT Machines Installed | Market Share (%) |

|---|---|---|---|

| 1 | GE | 3,671 | 44.75 |

| 2 | Siemens | 2,570 | 31.34 |

| 3 | Canon and Toshiba | 860 | 10.50 |

| 4 | Philips | 692 | 8.44 |

| 5 | Fujifilm / Hitachi | 268 | 3.26 |

| 6 | United Imaging | 82 | 1.00 |

| 7 | Neurologica | 30 | 0.37 |

| 8 | MinFound | 18 | 0.22 |

| 9 | Sinovision | 5 | 0.06 |

| 10 | Mobius | 3 | 0.04 |

| 11 | Campo | 1 | 0.01 |

| 12 | Scanco | 1 | 0.01 |

| 13 | Shimadzu | 1 | 0.01 |

| Total | 8,202 | 100 |

Similarly, in the MRI market, the top five players (Siemens, GE, Philips, United Imaging, and Fujifilm/Hitachi) command over 91% of the market share in terms of revenue.

| Sr. No. | Manufacturer | Number of CT Machines Installed | Market Share (%) |

|---|---|---|---|

| 1 | GE | 429 | 43.03 |

| 2 | Siemens | 332 | 33.30 |

| 3 | Philips | 131 | 13.14 |

| 4 | Canon and Toshiba | 45 | 4.51 |

| 5 | Fujifilm / Hitachi | 25 | 2.50 |

| 6 | United Imaging | 21 | 2.11 |

| 7 | Neurologica | 12 | 1.20 |

| 8 | Campo | 1 | 0.10 |

| 9 | Scanco | 1 | 0.10 |

| Total | 997 | 100 |

Market concentration can be assessed once market shares are calculated. It serves as an indicator of the potential for anticompetitive behavior, either through unilateral actions or collusion among market participants, which can be detrimental to consumers. One widely used metric for evaluating market concentration is the Herfindahl-Hirschman Index (HHI). The HHI is calculated by summing the squares of the market shares of all firms, assigning more weight to companies with larger shares. This characteristic reflects the idea that higher market concentration, indicated by a higher HHI, correlates with weaker market competition.

The HHI for the total installed CT scan machines in India is approximately 3,178. This value indicate a highly concentrated market. According to the U.S. Department of Justice’s Antitrust Division, an HHI between 1,500 and 2,500 indicates moderate concentration, while an HHI above 2,500 signifies a highly concentrated market. In contrast, the HHI for the MRI machine market value in India for 2022 is 2,348, indicating moderate concentration.

Market Size and Growth Potential:

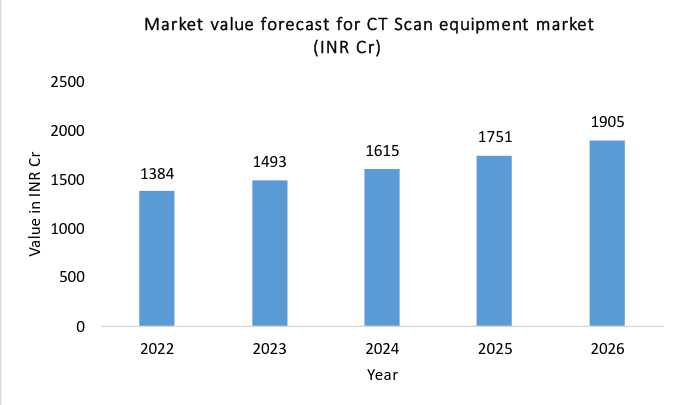

The market value of the Indian medical devices sector is estimated at INR 50,660 Cr in 2023. The overall diagnostic imaging equipment market in India had a market value of INR 14,422 Cr in 2022, INR 15,836 Cr in 2023, and the market value is projected to reach INR 20,968 Cr by 2026 at a CAGR of 9.8% (from 2022 to 2026). The projected market value for CT scan equipment segment (excluding spare parts and accessories) is estimated to reach approximately INR 1,905 Cr by 2026 from INR 1,384 Cr in 2022, at a CAGR of 8.3% during the same period. The figure below shows the forecasted market value growth of the CT scan equipment segment.

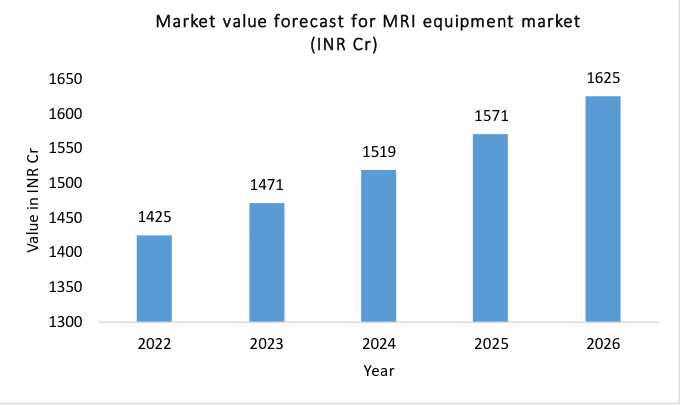

The market value from the MRI equipment market (excluding spare parts and accessories) is estimated to reach INR 1,625 Cr in 2026 from INR 1,425 Cr in 2022, growing at a CAGR of 3.3% per annum during this period. The figure below shows the forecasted market value growth of the MRI equipment segment. The numbers do not include spare parts and accessories.

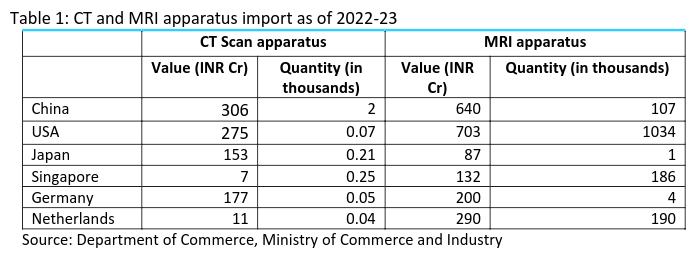

As per the website of the Department of Commerce, Ministry of Commerce and Industry, the total CT scanner apparatus imports (including spare parts and accessories) amounted to INR 1,010 Cr in the financial year 2022-23, while MRI scanner apparatus imports (including spare parts and ancillary components) reached INR 2,240 Cr during the same period. China, USA and Germany were the top import sources for CT scanners whereas, USA , China and the Netherlands were the top importer sources for MRI machines.

Pricing for purchasers of DMI and end users

The pricing of Diagnostic Medical Imaging (DMI) equipment, such as CT and MRI machines, depends on technical specifications, manufacturer, and features. Key observations on Original Equipment Manufacturers’ (OEMs) pricing strategies include:

- Specification-Based Pricing: Prices increase with higher technical specifications. For example, 128-slice CT machines range from INR 4-7 Cr, while lower-end 16-slice models cost INR 1-2 Cr. Similarly, 3-tesla MRI machines are priced at INR 12-14 Cr.

- Price Competition Among OEMs: CT and MRI prices from manufacturers like GE, Philips, and Siemens are competitive, as indicated by hospital and diagnostic center data. The GeM (Government e-Marketplace) portal shows a wide price range influenced by slice count or tesla level. GeM Portal Pricing: Only OEMs can list equipment on GeM after authorization, and they must offer at least a 10% discount. The listed prices, higher than those from stakeholder interviews, reflect government tender requirements. Final prices often result from financial stage negotiations.

- Negotiation Flexibility: Both government and private healthcare facilities can negotiate equipment prices. This was confirmed through consultations with private hospitals and diagnostic centers.

- Non-Price Competition: Besides price, DMI equipment procurement also considers factors like quality, reliability, service, and delivery time. The “PQRST” model evaluates equipment based on these attributes, emphasizing specifications, service reliability, and quick delivery.

Intra-brand competition among authorized dealers influences market dynamics, especially in the context of DMI equipment. In India, the OEM’s subsidiary often acts as an authorized dealer due to the smaller market size. Interviews revealed that some dealers have exclusive agreements preventing them from selling machines from other OEMs. While this insight comes from a single dealer, it suggests that exclusivity is used by OEMs to ensure proper training and capability-building for dealers, which is vital for maintaining quality and safety standards. However, such exclusivity may not apply to all dealers, as agreements can differ based on various factors and negotiations.

Multiple diagnostic centres have set up operations close to each other and were competing for patients. Prices of tests are often available online and many patients compare prices of tests available at other diagnostic centres and ask for discounts. To illustrate, below mentions the prices for CT and MRI brain scans across six study cities. It is important to note that the prices listed only cover the scan itself and do not include price of contrast media.

| Type of Establishment | Pune | HYD | Delhi NCR | Lucknow | Chandigarh | Bhubaneswar |

|---|---|---|---|---|---|---|

| CT Brain (Plain) | ||||||

| Private Hospital | 3,500 – 3,500 | 2,200 – 2,500 | 2,500 | 2,500 – 4,000 | 2,500 | |

| Diagnostic Centre | 4,000 – 4,500 | 1,500 – 2,500 | 1,000 – 2,500 | 2,200 – 2,500 | 1,500 – 1,800 | 2,000 – 2,500 |

| PPP* Centre | - | - | 900 | - | - | 750 |

| Charitable Hospital | - | 500 | - | - | - | - |

| Government | - | - | 200 – 1,000 | - | 300 | - |

| MRI Brain (Plain) | ||||||

| Private Hospital | - | 8,700 – 9,900 | 7,000 – 8,000 | 6,000 | 7,000 | 7,000 |

| Diagnostic Centre | 8,000 | 3,590 – 8,400 | 2,500 – 8,000 | 6,000 | 4,500 – 5,000 | 6,500 |

| PPP* Centre | - | - | 2,000 | - | - | - |

Barriers to entry

Barriers to entry in the Diagnostic Medical Imaging (DMI) market include:

- High Equipment Costs: Procuring DMI equipment requires substantial initial capital. Advanced technology machines are expensive, and import duties and taxes further inflate prices. Import duties are 7.5% for MRI and 10% for CT machines, with an added 5% health cess and 12% GST, making equipment costs a significant obstacle for new entrants.

- High Operating Costs: Operating DMI equipment incurs significant expenses, including preventive maintenance and electricity for air conditioning to maintain optimal equipment temperature. Additionally, these machines require large spaces, increasing rent costs for hospitals and diagnostic centers.

- Lock-In Period: Once purchased, equipment generally locks hospitals and diagnostic centers in for 7-10 years. The high cost makes frequent replacements impractical, even if there are issues with the equipment or after-sales service, further limiting flexibility for new or smaller players.

What could improve the situation for end users

A phased approach is recommended to enhance competition and local manufacturing in India’s Diagnostic Medical Imaging (DMI) equipment market.

- Promoting Local Manufacturing and Partnerships

Phase-wise Expansion: Encourage OEMs to increase assembly operations within India, which could evolve into full-scale manufacturing. This involves assessing and upgrading manufacturing capacities across the country. Supportive Ecosystem: Establish partnerships similar to successful models in the automobile industry, such as Maruti’s Center for Excellence, to facilitate knowledge transfer, innovation, and quality improvement. Collaboration with foreign OEMs can benefit Indian companies through technology transfer and local supply chain development.

- Strengthening Local Capabilities and Innovation

Fostering Startups: Develop government-backed programs, PPP initiatives, and seed funding for biomedical engineering startups focusing on medical component design and software. This would boost technological growth and global competitiveness. Infrastructure Development: Establish medical device parks and NABL-accredited testing labs to ensure quality standards. A coordinated effort from government agencies and stakeholders will drive infrastructure support.

- Improving Transparency and Market Access

Self-Regulatory Measures: OEMs should offer clear cost breakdowns for maintenance services, details on spare part availability, and transparent lifecycle costs to aid hospitals in making informed purchasing decisions. Open Market Access: Enable independent service organizations (ISOs) and dealers to access spare parts and ancillary components, promoting competition and flexibility in the market.

These strategic steps aim to optimize costs, increase demand, and position India as a key player in the global DMI market.

References

- Data on number of CT scan machines installed.

- India Medical Devices Report – 5-Year forecast to 2026. Fitch Solutions (2023)

- Report by Competition commision of India